Latest News

Tuesday, November 25, 2025

Thursday Closing Time Update

Beginning January 8, 2026, our branches will now close at:

5:00 PM on Thursdays

All other hours remain unchanged:

- Fridays: Open until 6:00 PM

- Saturdays: 9:00 AM - Noon (Plumsteadville Branch Closed)

Thank you for your understanding and continued trust in RFCU!

Monday, November 3, 2025

Introducing the next generation of Riegel Internet Banking!

Modern. Intuitive. Customizable to you.

Get ready for a whole new digital banking experience! Access all the features you need with ease— no more buried navigation items. And customize your homepage to make it uniquely yours.

Here’s what’s new:

- Enjoy a consistent experience across online banking and the mobile app.

- See due date and past due information—and click to view statements, make payments or transfer money - right from the Accounts widget.

- Control which features appear on your homepage by adding widgets to your “favorites.” And collapse, expand or reorder them at any time.

- See key messages upfront and customize the name you’re greeted with when you sign on.

- View your five most recent transactions without having to click into an account.

Log into Riegel Internet Banking (RIB) our the RFCU Mobile Application to experience the next generation experience!

Friday, August 1, 2025

Let Freedom Drive! Our Low Loan Rates Extended Through Labor Day Weekend!

Wednesday, July 30, 2025

Now Available: RFCU Contactless (Tap-To-Pay) Riegel Check Cards.

|

| The new Riegel Federal Credit Union "Burgundy Swash" Contactless 'Tap-To-Pay' Debit Card |

We’re excited to announce that RFCU is now issuing Contactless Tap-to-Pay Riegel Check (Debit) Cards for added convenience and faster checkouts. All new and replacement debit cards will include this secure tap-to-pay feature.

In addition to upgraded technology, our new cards feature a fresh “Burgundy Swash” design, replacing the previous dollar bills image.

Please note: We are not doing a mass reissue. Current debit cards will continue to work as usual. If you’d like to upgrade early, you can request a replacement card for our standard replacement card fee. Otherwise, you’ll receive a contactless card automatically when your current card expires.

Questions? Contact us—we’re here to help!

Friday, July 25, 2025

Recipients from our 2025 Riegel Federal Credit Union Golf Outing

Thank you to everyone who supported our 20th annual Riegel Federal Credit Union Golf Outing that was held on May 19, 2025. Together we raised more than $10,000 to benefit the Lebanon Borough Fire Company, Three Bridges Volunteer Fire Company, and the West Amwell Fire Company.

|

|

| Lebanon Borough Fire Company | West Amwell Fire Company |

|

|

| Three Bridges Fire Company | |

Monday, June 2, 2025

Time to hit the road!

Monday, May 12, 2025

Riegel Federal Credit Union Members Eligible for $20,000 in LendKey Scholarships

Milford, NJ (May 12, 2025) — Riegel Federal Credit Union is pleased to announce their members are eligible to apply for the 2025 LendKey Scholarship Program, which is awarding $20,000 in scholarships to help students achieve their academic goals.

LendKey is offering ten merit-based scholarships of $2,000 each to high-achieving undergraduate students who are members of participating credit unions like Riegel Federal Credit Union. These one-time awards are available to students enrolled full-time at an accredited four-year college or university and who meet the program’s eligibility criteria.

"We are committed to supporting our members’ educational journeys, and we’re excited to be able to offer this opportunity,” said Scott B. Husted, President/CEO. “We encourage all eligible members to apply and take advantage of this valuable scholarship program."

Applications are open from May 1 to May 31, 2025, at lendkey.com/scholarship. The selection process is managed by Kaleidoscope, an independent scholarship platform, and considers academic achievement, community involvement, and other qualifications. Winners will be announced in July.

For more information and to apply, visit lendkey.com/scholarship.

Friday, May 2, 2025

eCustomer Service (eCS) Deactivation

If you are currently using the eCustomer Service (eCS) website, please note that this website will be deactivated on June 2, 2025. The Credit Union recently launched our Card Connect service in RIB (Riegel Internet Banking) and RIB Mobile which offers a more secure and informative experience for our members.

Tuesday, April 8, 2025

Don't Tax My Credit Union

Even as the credit union movement has grown, it remains a small but vital part of the financial landscape: Credit unions serve 43% of all Americans, but hold only 8.8% of assets in financial institutions, a clear indication of efforts to help people build their savings and improve their finances. The remaining 91.2% of Americans’ assets are held by banks.

But that hasn’t stopped banks’ greed and desire to eliminate any competition. That’s why they want Congress to eliminate the credit union federal income tax status.

Eliminating this would mean all of the things people love about credit unions would be eliminated too. And at the expense of consumers like you.

Tell Congress: Don’t tax my credit union—it’s a tax on me.

Federal lawmakers are working on tax reforms. They need to know how eliminating the credit union federal income tax status would hurt the very people they were elected to serve. A new tax on credit unions would put your financial well-being at risk. Send a message to your U.S. Representative and Senators now and tell them to oppose any effort to add a tax on credit unions.

Wednesday, March 26, 2025

April is Credit Union Youth Month!

Children––just like adults––will be much more motivated to save their money if they have a specific goal in mind. Help them set their sights on something to save up for, remind them of their goal whenever they get an inclination to spend, and watch them as they experience the thrill of achieving an accomplishment!

Please click below to download some fun activities to share:

A Sea of Savings Coloring Page

A Sea of Savings Crossword Puzzle

Thursday, March 13, 2025

Sign up for eStatements and save!

Sign up for eStatements today and avoid the $3.00 fee for printed statements. Simply Log on to RIB (Riegel Internet Banking) or the RFCU Mobile App and select "eStatements" to sign up. Online statement history will be retained for up to 18 months and all statements are viewable electronically in PDF (Portable Document Format) which can be viewed online, saved to your computer, or printed at your convenience. If you're not yet signed up for RIB, please click here to register for access.

Monday, February 18, 2025

Register today for the 20th Annual Riegel Federal Credit Union Golf Outing!

The Credit Union will be holding its 20th Annual Golf Outing on Monday, May 19th, 2025 at the Oak Hill Golf Club in Holland Township, NJ. The beneficiaries of this year's outing will be the Lebanon Borough Fire Company, Three Bridges Volunteer Fire Company, and the West Amwell Fire Company.

Please click here to download the registration form.

Wednesday, November 13, 2024

Riegel Card Connect is here!

We are excited to launch our newest application - Riegel Card Connect. This is a feature that will assist our credit and debit card users in streamlining card management on Riegel Federal Credit Union cards. As a cardholder, you will have access to card activity in a new way. By adding your card to Card Connect in RIB (Riegel Internet Banking) or the Riegel Mobile app, you can view and manage your card with Card Connect's Controls & Alerts, Travel Plans and more. You can also view card details like: Digital Card, Spend Insights, and other valuable information. Misplace your card? You can use the ‘turn it off” feature until the card is found or needs to be replaced. You are in control with Riegel Card Connect. Visit the Card Connect page of our website for more information.

Tuesday, August 6, 2024

The 2024 Riegel FCU Golf Outing Beneficaries

Thanks to the support from all our sponsors, golfers, and volunteers, we were able to present each of our beneficiaries with a donation of $3,000.00. The Annandale Fire Company, Frenchtown Fire Company, and the Kingwood Fire Company were all presented with donations that will help them further their impact within the community.

|

.jpg) |

Annandale Fire CompanyRFCU Assistant-Branch Manager (Clinton), Carley Brandau, presents a check for $3,000.00 to Annandale Fire Co. Chief Tom Long and President Marc Strauss. |

|

|

|

Kingwood Township Fire CompanyRFCU Assistant-Branch Manager (Milford), Nicole Cihanowyz, presents a check for $3,000.00 to Kingwood Township Fire Co. Chief Frank Floyd and President Rich Vuono. |

Frenchtown Fire CompanyRFCU Chief Membership Business Officer, Deb Phillps, present a check for $3,000.00 to Frenchtown Fire Co. Chief Mike Atheras. |

None of this would have been possible without the amazing support the Credit Union received from the community. Thank you for partnering with us to make a difference.

Wednesday, July 24, 2024

August is National Make-a-Will Month!

August is National Make-a-Will month, making it an ideal time to finalize your estate plan. Despite any hesitation or procrastination, rest assured that the process is simpler, quicker, and more affordable than you might expect. Trust & Will is the leading online estate planning platform that makes creating or updating your Will or Trust easier than ever. We've partnered with them to provide you exclusive savings of 20% off any estate plan. Wills start at just $159 with a Riegel FCU member discount. With Trust & Will you can:

- Nominate child and/or pet guardians

- Decide who will handle your affairs

- Leave specific gifts (money, possessions, property, etc.)

- Determine how your assets will be distributed.

We believe everyone should have access to estate planning. Get Started with Trust & Will and secure your legacy today. Click here to save 20% on any online estate plan at Trust & Will.

Monday, June 10, 2024

June 15th is World Elder Abuse Awareness Day

June 15th is World Elder Abuse Awareness Day. Older people throughout the United States lose an estimated $2.6 billion or more annually due to elder financial abuse and exploitation. Elder abuse also creates health care and legal costs for our society. However, we can change this. Learn more: http://eldermistreatment.usc.edu/weaad-home

Monday, April 22, 2024

eStatements are now availble in the Riegel FCU mobile applications

If you have enrolled for eStatements in Riegel Internet Banking (RIB), you can now access your RFCU statements through the Riegel FCU mobile applications. Select the "more" menu optoin at the bottom right of the mobile app to access the eStatements. You will need to have the free Adobe Acrobat Reader installed on your phone in order to view the statements. Other PDF applications such as Microsoft Office 365 may also work to open the PDF statement files.

Friday, April 19, 2024

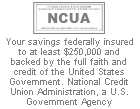

Goal Builder now available in RIB and Mobile Applications

The Credit Union launched a new feature in Riegel Internet Banking (RIB) and our mobile apps called Goal Builder. The Goal Builder widget shows up on the front page under the Bill Pay widget once you log into RIB and can also be found under the "Manage Money" menu at the top. In the mobile applications, it is listed right below eStatements in the "More" menu option located in the lower righthand corner.

Goal Builder offers visualization for multiple goals such as saving for a vehicle, down payment for a home, or saving for a vacation. Members will be able to use a single account to drive all of their goals and can set up goals according to their priorities and see their remaining balance after accounting for their goals. Goals are created individually, so you will be able to determine how much to designate and how frequently through "set it and forget it" rules to achieve your target goal amount.

Wednesday, March 6, 2024

Help us Slam the Scam!

Help us #SlamtheScam on National Slam the Scam Day, March 7, 2024.

Download the Social Security Administration's scam information document by clicking here.

Learn more about Social Security Scams by visiting https://www.ssa.gov/scam/